More Fields, Fewer Subscribers

Posted by Chad S. White on March 28, 2013

Companies spend a lot of time and money optimizing their online checkout pages because they know that checkout abandonment is money lost. The same is true of email subscription forms—higher abandonment means slower list growth and therefore less money generated by the email program. Yet, brands don’t appear to be giving these forms nearly the same level of attention.

After signing up for emails from more than 160 B2C brands, I saw many behaviors that are reducing signup completions, including:

After signing up for emails from more than 160 B2C brands, I saw many behaviors that are reducing signup completions, including:

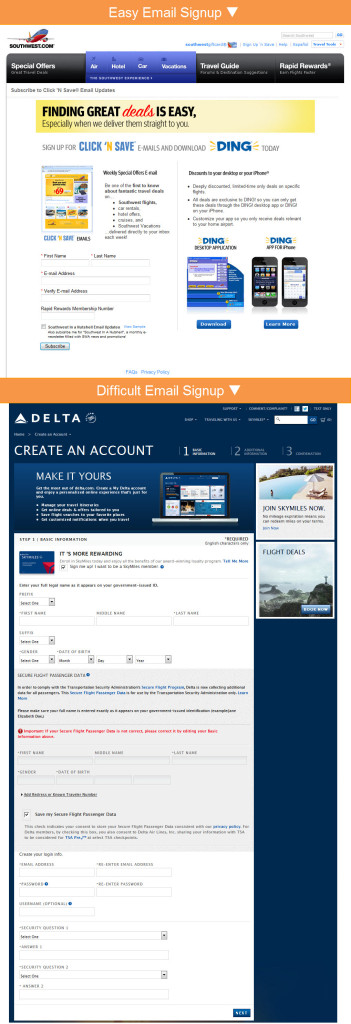

Forcing consumers to register in order to receive emails. An email relationship is an incremental one. It’s like a conversation—You don’t blurt everything out at once in a huge monologue, but rather reveal a little at a time over the course of the back-and-forth of the conversation.

It starts with them sharing their email address, and then if they enjoy what you say after that then they give you more information through email and browse behavior, via progressive profiling, and by checking out or registering.

For example, Southwest Airlines eases into the email relationship, asking for relatively little information. On the other hand, Delta Air Lines requires consumers to register with their site in order to receive emails. The “Basic Information” portion of their registration form alone has 25 fields and includes TSA warnings that get people thinking about airport hassles instead of saving on a fun getaway.

Very few retailers still require consumers to register in order to sign up for promotional emails, but many non-retailers still require registration.

Asking for too much information, especially additional contact information. Even if they’re not asking you to register with the site and set up a user name, password and security questions, some brands are just one step shy of that and ask for mailing addresses, phone numbers and other details that have absolutely nothing to do with fulfilling an email subscription.

Not only do more fields lower completion rates, but consumers are suspicious of brands who ask additional points of contact like mailing addresses, which lowers completion rates even more, according to research. Especially if you sell online, there’s no reason to try to grab tons of information upfront, because if your emails are effective then your subscribers will be buying from you and you’ll collect mailing addresses and phone numbers during checkout.

Most retailers have figured this out, with many only asking for a consumer’s email address in order to opt in. Some also ask for a zip code to do segmentation or personalization, and some ask for a first name for personalization. But many non-retailers are well behind the curve when it comes to keeping email opt-ins simple and then using progressive profiling or checkouts to collect additional information.

Making consumers accept content they don’t want to get the content they do want. You would like for consumers to be interested in all of your brands, and you’d certainly like to leverage their interest in one of your brands to get them interested in your others. But you have to tread softly.

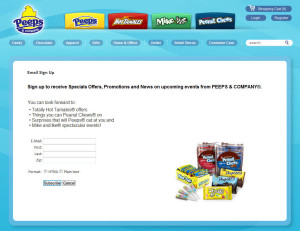

For instance, Peeps and Company doesn’t give their subscribers a choice as to which brands they get content from. If you want to get Peeps updates, you also have to get updates about Peanut Chews, Hot Tamales, and Mike & Ike. Let your subscribers choose which products they’re interested in and make that the focus of your message, and use secondary messaging to occasionally promote your other brands.

All three of these practices reduce email signups. What’s more, our research only looked at homepage email opt-ins, which are generally among the most productive you can get. So the opportunity cost of long and inefficient forms there is higher than average.

Category: Uncategorized

Welcome! Email Marketing Rules is your guide to understanding the best practices of this complex, often misunderstood channel as you craft the best executions for your brand. Every week, we’ll explore strategies and tactics, discuss tips and inspiration, and dig into industry news and trends.

Chad S. White

Head of Research

Oracle Digital Experience Agency

Author of Email Marketing Rules and nearly 4,000 articles about digital and email marketing

Topics

Recent Posts

Archives

- June 2025 (7)

- May 2025 (6)

- April 2025 (4)

- March 2025 (5)

- February 2025 (7)

- January 2025 (7)

- December 2024 (7)

- November 2024 (5)

- October 2024 (9)

- September 2024 (9)

- August 2024 (7)

- July 2024 (4)

- June 2024 (6)

- May 2024 (6)

- April 2024 (6)

- March 2024 (9)

- February 2024 (10)

- January 2024 (7)

- December 2023 (7)

- November 2023 (6)

- October 2023 (9)

- September 2023 (6)

- August 2023 (9)

- July 2023 (7)

- June 2023 (8)

- May 2023 (8)

- April 2023 (9)

- March 2023 (9)

- February 2023 (6)

- January 2023 (10)

- December 2022 (5)

- November 2022 (7)

- October 2022 (9)

- September 2022 (9)

- August 2022 (6)

- July 2022 (5)

- June 2022 (8)

- May 2022 (7)

- April 2022 (4)

- March 2022 (9)

- February 2022 (7)

- January 2022 (7)

- December 2021 (5)

- November 2021 (7)

- October 2021 (9)

- September 2021 (7)

- August 2021 (9)

- July 2021 (6)

- June 2021 (8)

- May 2021 (6)

- April 2021 (3)

- March 2021 (6)

- February 2021 (6)

- January 2021 (9)

- December 2020 (8)

- November 2020 (6)

- October 2020 (10)

- September 2020 (9)

- August 2020 (8)

- July 2020 (10)

- June 2020 (12)

- May 2020 (6)

- April 2020 (5)

- March 2020 (8)

- February 2020 (6)

- January 2020 (7)

- December 2019 (6)

- November 2019 (5)

- October 2019 (8)

- September 2019 (3)

- August 2019 (4)

- July 2019 (6)

- June 2019 (3)

- May 2019 (7)

- April 2019 (2)

- March 2019 (4)

- February 2019 (3)

- January 2019 (5)

- December 2018 (9)

- November 2018 (7)

- October 2018 (11)

- September 2018 (7)

- August 2018 (9)

- July 2018 (7)

- June 2018 (5)

- May 2018 (5)

- April 2018 (7)

- March 2018 (8)

- February 2018 (3)

- January 2018 (6)

- December 2017 (8)

- November 2017 (8)

- October 2017 (4)

- September 2017 (6)

- August 2017 (5)

- July 2017 (11)

- June 2017 (9)

- May 2017 (8)

- April 2017 (5)

- March 2017 (5)

- February 2017 (3)

- January 2017 (5)

- December 2016 (11)

- November 2016 (6)

- October 2016 (5)

- September 2016 (10)

- August 2016 (10)

- July 2016 (6)

- June 2016 (6)

- May 2016 (8)

- April 2016 (7)

- March 2016 (9)

- February 2016 (8)

- January 2016 (8)

- December 2015 (7)

- November 2015 (8)

- October 2015 (7)

- September 2015 (8)

- August 2015 (4)

- July 2015 (8)

- June 2015 (4)

- May 2015 (6)

- April 2015 (8)

- March 2015 (6)

- February 2015 (9)

- January 2015 (7)

- December 2014 (13)

- November 2014 (7)

- October 2014 (9)

- September 2014 (11)

- August 2014 (13)

- July 2014 (9)

- June 2014 (6)

- May 2014 (8)

- April 2014 (6)

- March 2014 (11)

- February 2014 (7)

- January 2014 (8)

- December 2013 (10)

- November 2013 (8)

- October 2013 (11)

- September 2013 (10)

- August 2013 (12)

- July 2013 (9)

- June 2013 (10)

- May 2013 (12)

- April 2013 (7)

- March 2013 (9)

- February 2013 (5)

Email Marketing Rules

Email Marketing Rules